Startups / Emerging

Companies

Corporate Venture

Groups

Securities / Corporate

Transactions

Mergers &

Acquisitions for

Buyers and Sellers

Web 3.0

ABOUT LOUIS LEHOT

Louis Lehot is a partner within the Silicon Valley, San Francisco, and Los Angeles offices of Foley & Lardner LLP focused on advising clients at all stages of company growth from garage to global. He offers comprehensive business and legal advice for entrepreneurs, executive management teams, investors, financial sponsors and their advisors. Louis advises emerging ……

Foley Significantly Expands Capabilities In The Fast Growing Technology And Life Sciences Sectors.

ARTICLES PUBLISHED

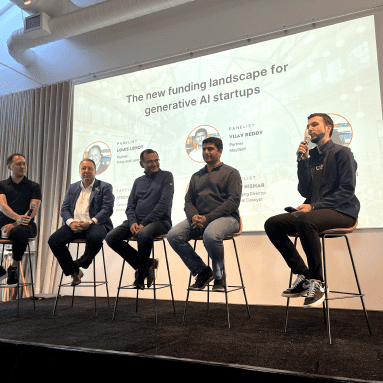

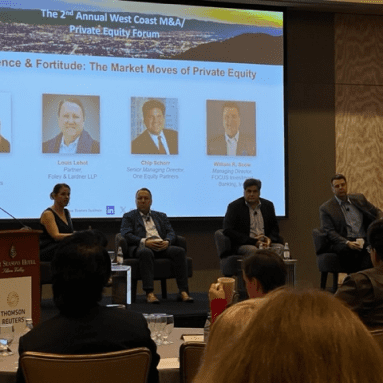

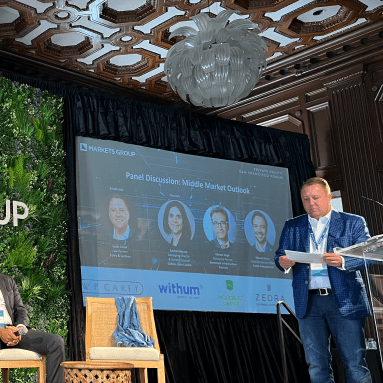

SPEAKING ENGAGEMENTS

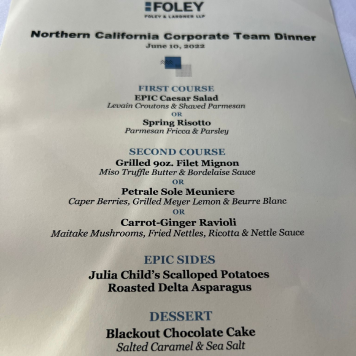

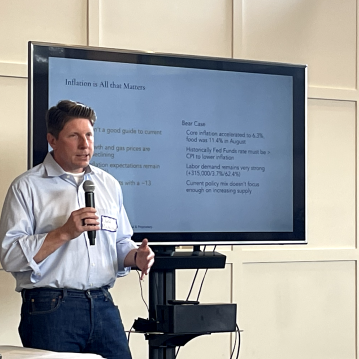

OUR GALLERY

FREQUENTLY ASKED QUESTIONS

- Q1. What industries does Louis Lehot specialize in?

Louis Lehot is a leading corporate lawyer specializing in mergers and acquisitions, private equity and venture capital investments, and helping innovative companies go “garage to global.” He works with organizations in an array of industries including technology, healthcare, life sciences, and clean energy.

Louis provides practical, commercial and strategic legal counsel to private and public companies involved in growth and liquidity events. He works on deals involving venture funding, mergers, acquisitions, spinoffs, strategic investments, and joint ventures. In addition, companies and investors seek Louis out for counsel in forming companies, financing, governing, and buying and selling businesses.

Importantly, Louis has always taken a keen interest in supporting companies as they cross borders and enter new markets abroad, helping them navigate the legal and cultural landscape successful overseas expansion must cross.

Louis regularly represents companies in numerous industries—public or going public, US and non-US registrants—in dealing with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, the New York Stock Exchange, and the NASDAQ stock exchange.

- Q2. What is the significance of mergers and acquisitions in the current business landscape?

Mergers and acquisitions represent one of the most common and often the most beneficial exit strategies for startups. M&A plays a leading role in integrating innovation into markets over the longer-term.

Tech entrepreneurs and startups are driven by much more than profit. These innovators are passionate about their inventions and want to see the products they develop in action, changing people’s lives and becoming mainstream in the long term—from new medicines to AI applications and apps that help manage your diet.

By finding the right M&A partner and negotiating the right deal, startups can both cement a strong future for their innovation and achieve the best financial results for the innovators and their investors.

When startups reach maturity, they have to take the next step. For the majority, an IPO is either not possible or is not the best option. For instance, the inventor of a fingerprint biometric scanner for smartphones has a product better suited for an M&A, since the technology is only a small part of a bigger device.

However, finding the most suitable M&A partner and structuring a deal that meets the startup’s and founders’ hopes and goals can be difficult. Wrong decisions and wrong deals can destroy years of hard work. And that’s only step 1. Step 2 is the legal expertise and efforts needed to outline the deal and oversee the due diligence involved on both sides.

- Q3. What services does Louis Lehot offer for M&A transactions?

The term M&A is a broad one that means different things to different companies in different deals. An M&A transaction may refer to one company purchasing or absorbing another, a merger where two companies join together, an acquisition of major assets in a company, a tender offer to buy a company’s stock, or a hostile takeover. Companies large and small, public and private, need ongoing counsel to help them identify, structure and execute the deal that’s right for them, provide the legal framework that can optimally make it happen —and then make sure it happens successfully.

Louis Lehot represents buyers in creating acquisition programs, selling companies, purchasing assets, merging with other firms, and licensing. Louis’s clients range from bootstrapped startups to venture-backed emerging growth companies, to public companies, and the venture capital and private-equity financial sponsors that fund these entrepreneurs. His clients have included venture capital and private equity firms and corporate venturing groups that make investments in technology, healthcare, clean energy, and other innovative businesses.

Louis’s aim is to achieve liquidity events that are win-win for both sides, entrepreneurs and investors, and to create the right market fit for the innovative products involved.

- Q4. How can legal support enhance private equity and venture capital endeavors?

The process of investing and acquiring startups can be wildly lucrative, but at the same time wildly risky. Parties on both sides of a deal need to find the right partner, the right deal, and importantly, the right legal counsel to ensure the best options are sought and that everyone does their part to ensure success.

Legal counsel create the legal framework to make it all happen. This includes:

Structuring the deal. A well-structured deal maximizes returns while minimizing risks. At the same time, transactions must meet regulatory requirements and serve the interests of investors and partners on both sides.

Contracts. The legal governor of all investments is the documentation and contracts that outline the deal and spell out all that is expected. The legal counsel behind these investment deals drafts investor agreements, shareholder agreements, and employee contracts—all to apportion the risks and rewards, incentivize and align the parties for success, reduce the likelihood of disputes and have in place a plan of action for when disputes do arise.

Due diligence. A strong legal team helps an investor test the price and conduct thorough due diligence (and a company defend price against a thorough due diligence investigation) to identify legal risks in a deal. Issues may involve commercial contracts, intellectual property rights, regulatory compliance, past or ongoing litigation, and other legal aspects.

Risk management. Legal teams identify and mitigate potential legal risks in investment, on everything from assessing potential legal liabilities to protecting investors’ interests.

Exit strategies. Both sides of an investment are there for the same reason: reaching the point where it all pays off. A well-structured and documented deal will outline exit strategies so that when the time comes, all parties are ready with a roadmap in hand.Dispute resolution. Disputes will happen: It’s human nature and it’s why the best legal counsel is sought for investments. Strong counsel will both anticipate possible disputes and seek a favorable resolution when they occur.

- Q5. What role do legal professionals play in the technology sector?

IP protection. When an inventor, entrepreneur, or startup develops a novel technology, the first step in bringing it to market is legal counsel, to protect intellectual property and to explore deals that may fund its development and initial marketing. Among the issues legal counsel will advise on or oversee are:

Intellectual property protection. Entrepreneurs and companies developing technology must constantly be working to protect it. Protection includes filing for patents, trademarks, and copyrights, as well as working to avoid infringement, enforce rights, and defend against infringement should rivals claim they got the idea first.

M&As. Mergers and acquisitions are goals of most startups, a time to cash in on years of hard work, pay off now-happy investors, and set innovations permanently onto the market. Legal counsel oversees deal structuring, contracts and documentation, due diligence, regulatory compliance, and other essential legal details.

Litigation and dispute resolution. Unfortunately, the tech world is as competitive as it is innovative, and too often that winds up involving litigation. It can come from any direction, from patent trolls (companies that file patents only so they can sue future inventors) to competitors to investors. This is why tech companies hire legal professionals who are experts at IP law, infringement and pirating, contract breaches, and other relevant areas of law.

- Q6. How do lawyers serve clients in the Health Care and Energy industries?

Lawyers serving clients in the Health Care and Energy industries help navigate and solve complex issues unique to these sectors.

In the Healthcare industry, attorneys may assist clients with regulatory compliance, healthcare contracts, licensing, and addressing issues related to patient care and privacy. Healthcare lawyers may also be involved in matters such as healthcare litigation, medical malpractice defense, and advising on the implications of healthcare policies and regulations.

In the Energy industry, legal professionals may help clients with regulatory compliance, environmental law, project development, and negotiations with stakeholders. They specialize in areas such as renewable energy, oil and gas, and utilities, offering legal support on project financing, permits, and compliance with environmental regulations and industry standards.

- Q7. What role do legal professionals play in providing services for emerging private companies

Legal professionals support emerging private companies by providing legal services tailored to a company’s specific needs. This may include assisting with entity formation, advising on risk management, drafting and negotiating contracts, intellectual property protection, employment matters, and regulatory compliance, among others. Lawyers also help such companies through legal issues related to financing, mergers and acquisitions, and corporate governance.

Additionally, they may assist in litigation and resolving disputes, offering legal representation when necessary. Overall, legal support is essential for emerging private companies to establish a strong foundation and thrive in their respective industries.

- Q8. What Do I Need to Consider When Building an NFT Marketplace?

NFTs present an opportunity to excite fans and collectors. When an artist or creator sells an NFT, he or she retains the right to the underlying content. They are an opportunity to enforce property rights on digital versions and are typically sponsored by the actual owners of the copyright.

In an NFT marketplace, a platform that connects content creators with sellers, sellers mint NFT tokens and buyers can browse listed assets or participate in an auction. The marketplaces exist on blockchains. Once an NFT is minted on one of the blockchains, it is not easily transferred or sold on another. It is important to research carefully and choose the blockchain wisely.

Here are other critical steps to take:

-

- Protect yourself by forming a corporate entity before launching a marketplace. In addition to providing substantial liability protection, a corporate entity offers credibility when seeking financing.

- Draft or obtain a code of conduct to govern interactions on the platform.

- Create smart contracts with transferable ownership. Build-in the economics of trading—how much will a primary sale cost? How much for secondary sales, royalties, transaction costs and other aftermarket features?

- Generate or acquire platform Terms of Service to govern the relationships between you as the NFT marketplace operator and customers and between the buyers and sellers of the NFTs featured on the platform. Your terms of service may protect you from various legal issues and limit your overall liability.

- Verify each participant’s intellectual property rights at every stage of each NFT transaction. Allocate intellectual property rights among the creators/artists, purchasers/collectors, and other parties. The ownership of the original work is copyright ownership, which vests in the creator of the original work. If an NFT is minted and sold, the purchaser will receive a set of intellectual property rights from the creator as part of owning the NFT. The seller of the NFT determines the rights that accompany an NFT.

- Comply with all securities laws. Be sure to design features that demonstrate the distinction between your NFT and what governments seek to regulate. For example, the proceeds of the primary and secondary sales should not be used to build other NFTs, the platform, or the marketplace. Since currency is fungible, this requires careful planning.

- Use caution in setting up payments. If payments are processed on behalf of counterparties, the party touching the money may be a “money transmitter” with its activities governed by applicable Treasury, state, and local registration regulations. To avoid the complex process of registration in innumerable jurisdictions, many marketplaces partner with already-registered entities, acting as content creators rather than payment processors. But watch for commissions, gas fees and other transaction costs associated with validating transactions and processing payments. How is each payment characterized? Is it a fee for content creation or money transmission? This is a key question for compliance.

- Protect consumers. Adequately inform customers about what they are purchasing and the risks involved so that you avoid FTC allegations of deceptive or unfair advertising. Make certain that you have installed robust controls to guard against cybercriminals. You may also need to implement KYC (Know Your Customer), anti-money laundering, and other regulatory requirements.

- Data privacy. Be transparent about data collection and use! The fines for privacy violations can be significant.

- Pay where payment is due. With each piece of content and each media in which it is reproduced or tokenized, a different license fee may be payable to a different entity in the stream of commerce. Analyzing each contract involved in the monetization of content is a key task, and care should be taken to follow the trail through each transaction in the metaverse.

-

- Q9. How are SAAS companies valued upon a sale of the company or capital raise?

New data from KeyBanc Capital Markets (KBCM) shows that SaaS companies are poised to power the post-pandemic recovery. KBCM surveyed senior executives at more than 350 private SaaS companies in June and July 2021. As with many industries, growth for companies in the global private SaaS sector slowed to 28% (median growth rate) during 2020. Forecasts for 2021 show levels returning to a median of 36% during 2021. Valuation statistics showed a median multiple of 8.4 times annual recurring revenue in a capital raise or change of control since January 2020. The full survey results can be found here.

- Q10. What Do I Need to Know About Equity Incentive Pools?

An equity incentive pool is a tranche of shares of common stock that are set aside for stock options, restricted stock or other equity instruments to help a business recruit, retain, incentivize, and align key talent for long term value creation and success. Startup companies often use these shares in lieu of cash to compensate employees, directors, advisors, and consultants.

Why do I need an equity incentive pool?

Equity incentive pools reflect how much of your company you can retain. Each time a grant is made, you are making a statement about your company’s valuation.Why does the size of my equity pool matter?

Suppose your company is using the equity pool for compensation and incentives to attract and retain early hires. In that case, a company needs to have a large enough equity pool to make enough grants to fill out the team. Be careful to assess the dilutive impact on the ownership interests of founders and other shareholders when the company decides to raise more money. Benchmarks can help ensure your pool size is in range. However, you do not want to rely on them. There is an extensive range in the typical percentage founders set aside from less than 5% to 30% or higher. A rule of thumb is that a startup will create a 20% equity pool at formation, and that at a seed round, a seed investor will insist on upsizing the equity pool to equal 10-15% or greater in the pre-money valuation. A Series A investor will look to see that there is at least 10% of the outstanding share capital set aside in an equity pool and accounted for in the pre-money valuation. Investors will count promised but ungranted options in this calculation.

How does hiring affect the pool? Every startup should have an equity budget that rolls up to the total size of the equity pool. To do that, you need to understand which positions you need to fill in the next 18 to 24 months and how many options you would need to attract these critical hires. You will need to offer early employees more equity since they take a more significant risk of joining a relatively unproven company, and for usually below market salary and no bonus.

A good startup lawyer with experience in your space can help you plan and can share relevant data points about how much the market will demand for each key hire.How do I prevent dilution?

Investors prefer larger option pools, they will price it in the “pre-money,” to minimize the risk of dilution for them. Investors may pressure you into creating a larger pool than you need by reference to some benchmark in relation to the stage of your financing. This is why your hiring plan will help you create a more realistic pool. Remember, a company can always increase the size of the equity pool later if more shares are needed. - Q11. IPOs, Direct Listings, SPACs, and Mergers —how do I achieve a liquidity event for my company?

In an IPO, or initial public offering, a company makes an offering and an investment bank or other underwriter purchases the stock and makes it available to the public. The underwriter helps set the IPO price, assesses the level of interest in the stock, and manages all regulatory issues. A primary benefit of an IPO for the company making the offering is that the underwriter, charging a fee for its services, will usually either guarantee the sale of a certain number of shares or offer to purchase any shares that remain unsold. Having all regulatory issues managed and obtaining a guarantee of shares sold is a substantial benefit to offering companies, especially where demand for shares is not fully known.

When a company wishes to save the cost of hiring an underwriter or feels that an underwriter’s services are not required, it can register to sell its stock directly to the public via a direct listing. In doing so, a company and its stakeholders can avoid the lockup period of an IPO and resell additional shares on its own timetable. Without an underwriter, however, direct listings can be riskier in that there is no support for the initial stock price and no one to purchase unsold shares or make a market in the stock.

A SPAC, or special-purpose acquisition company, is a publicly traded “blank check” pool of capital with no operations, other than a small handful of executives and advisors who seek to consummate a “de-SPAC merger transaction.” These “blank check” companies look to acquire an unspecified target within a defined period. The target, once acquired, bolsters the stock price of the SPAC by the addition of its value. The time elapsed from commencement of negotiations to public trading is typically shorter for a SPAC than for a traditional IPO.

A PIPE, or private investment in public equity, deal involves the purchase of publicly traded stock, by a private investor (hedge or mutual fund, often), at a price below that available to a public investor. Typically, vast amounts of stock are purchased at a preferred price. Because only a small handful of purchasers are involved (the private investors), companies look to PIPE deals to raise substantial amounts of capital in a brief time frame to finance a de-SPAC merger transaction. PIPE deals are often employed to bridge part of the gap between the proceeds in trust held by the SPAC and the enterprise value of the combined company that will be the result of the de-SPAC merger.

- Q12. What’s A Delaware C Corporation and Why Do I Care?

Formed under the General Corporation Law of The State of Delaware, the corporation, known as a C Corporation, or stock or open corporation, is popular. Some 65% of Fortune 500 companies use this form as do more than 50% of all publicly traded companies. Delaware continues to be the foremost state for incorporating a business, as it has been since the early 1900s.

C corporations are taxed separately from their owners, under the U.S. federal income tax laws. In contrast, S corporations are not taxed separately. The C corporate form is beneficial to owners when the corporation wishes to lower taxes by reinvesting retained earnings. A disadvantage exists in those taxes can be assessed twice: at the corporate level and again at the shareholder level when a dividend is declared.

Advantages of incorporating in Delaware include the sophistication of the legislature and statutes governing corporations, the corresponding preference of investors for purposes of raising capital, the clear separation of rights and responsibilities between the parties involved, the absence of size limitation, and the judiciary that resolves disputes and interprets laws. Delaware’s Court of Chancery, consisting of a chancellor and four vice-chancellors, is thought to be more predictable than the courts of other states in that decisions are based on 200+ years of consistent case law and judicial procedure, the court has historically respected the good faith decisions of a Board of Directors over the desires of stockholders, and there are no jury trials in the Court of Chancery.

- Q13. Inbound And Outbound Expansion—How Do I Launch My Business in Global Markets?

Going global can turn a lifestyle business into a transformational business; it can be the difference between good and great. So, what does it take to grow globally, successfully? For those “coming to America,” it is important to set your business up legally and sustainably. You will encounter an entirely new stream of commerce with its unique set of regulations. Be ready to address legal and financial structure, IP protections, employment, contractors, distributors, manufacturing, product liability, federal, state, and local income, sales, and payroll taxes. Unchanged: For those “coming to America,” it is important to set your business up legally and sustainably. You will encounter an entirely new stream of commerce with its unique set of regulations. Be ready to address legal and financial structure, IP protections, employment, contractors, distributors, manufacturing, product liability, federal, state, and local income, sales, and payroll taxes.

As you set up your business in the U.S., you will choose how to structure your business: Unchanged: As you set up your business in the U.S., you will choose how to structure your business:

- Going Direct – You could do business directly through your existing corporate entity. This can, however, pose tax problems; you are exposing your non-U.S. revenues to the long arm of the U.S. legal and tax jurisdiction. For example, your home country operations and revenues would be exposed to U.S. product liability laws and federal, state, and local tax authorities. This option is often expedient for one-off transactions, but inadvisable for a strategy to penetrate U.S. markets.

- Setting Up a Branch, Subsidiary or Affiliated Entity – Other options include establishing a local entity affiliated with your corporate entity. This is a better option when looking to do business in the U.S. over the long haul as it provides better protections for your existing business. Depending on the type of business you operate and the type of market you seek to penetrate in the U.S., it might be most efficient to set up a wholly owned U.S. subsidiary in the State of Delaware (or elsewhere), a sister company owned by the same stakeholders but held independently of the home country entity, or a branch pursuant to multi-jurisdictional treaty.

- Partnering with Local Entity or Establishing Joint Venture – Other options include contracting with a qualified and compliant local entity through which your business can do business. This is a good option when looking to do business in a highly regulated industry or jurisdiction where costs to register or qualify to do business are too high to justify going it alone.

Similar considerations apply when U.S. companies look to do business abroad. Notably, it has long been the case that U.S. companies doing business in the People’s Republic of China should consider partnering with a local PRC company to pursue PRC markets.

Unchanged: Local law requirements in the US can implicate critical considerations, as well as the laws of any specific states in which you will be doing business. Do you have to have a local shareholder or director? Do you need a joint venture partner? What are the regulations surrounding the transfer of IP? What are the regulations surrounding citizenship requirements or permission to work? These are all issues that must be addressed. The same applies for US businesses going abroad. Unchanged: Local law requirements in the US can implicate critical considerations, as well as the laws of any specific states in which you will be doing business. Do you have to have a local shareholder or director? Do you need a joint venture partner? What are the regulations surrounding the transfer of IP? What are the regulations surrounding citizenship requirements or permission to work? These are all issues that must be addressed. The same applies for US businesses going abroad.

Unchanged: How will you direct human capital to advance your goals? Which entity can employ personnel or engage independent contractors? What are the payroll taxing considerations? How will you maintain compliance with laws and regulations governing human capital and taxes? Unchanged: How will you direct human capital to advance your goals? Which entity can employ personnel or engage independent contractors? What are the payroll taxing considerations? How will you maintain compliance with laws and regulations governing human capital and taxes?

Going global is fundamental to maximizing success. But going global involves complex, complicated issues. Expert advisors, such as a trusted lawyer with significant cross-border experience, can make all the difference. - Q14. What Can I Do to Limit My Data Liability?

Data drives the modern economy. By its very importance, it has become a target for hackers and bad actors. Whether it resides on third-party cloud servers or locally, the risks are significant and potentially disastrous. Data security, or lack thereof, poses a direct risk to consumer privacy, as it subverts the purpose for which personal information was disclosed and subjects the consumer to loss of privacy, financial harm, falling victim to scams, and other potential negative consequences.

Whether you are planning new data security policies or revising old ones, consider how to minimize your data liability. Though not practical for every situation, the best way to limit your data liability is not to collect the data in the first place (i.e., data minimization). As a simple example, in our data-driven world, users are frequently asked to provide personal information. Accessing a report might require giving out a name and an e-mail address or creating an account. That data might be useful to you for creating a mailing list, but the privacy implications are increasingly driving users to keep extra e-mail accounts as spam filters so that they can get the information they want without being bothered by newsletters.

A key question you should ask is whether collecting that information is truly necessary. The easiest way to ensure that your company does not suffer a data breach is to have no data to breach. By minimizing the information you collect, you make your systems less attractive to hackers. Also, how long do you need to retain data once it has been collected? Don’t retain data any longer than necessary.

When you must collect and retain data, make sure you secure it properly. Follow best security practices; encrypt information where possible. Homomorphic encryption is a means of protecting data cryptographically while still allowing certain calculations to be performed on it. You should also consider technological innovations in achieving data processing objectives while minimizing your data liability. For example, businesses today may utilize edge computing architecture to process data at the device level, instead of transferring the data to a central cloud server for processing. Through distributed data processing, businesses may be able to enact a higher level of anonymization and data protection yet achieve their business objectives.

- Q15. Is Equity Crowdfunding Right for My Company?

Traditional crowdfunding platforms, such as Kickstarter, Indiegogo and Patreon, operate on rewards-based systems whereby retail investors contribute cash in exchange for gifts, products, or discounts. Equity crowdfunding, on the other hand, is a method of investing into private companies in exchange for equity. It allows startups to raise funds from and pitch to a crowd of small, individual investors through internet-based platforms with built-in regulatory and legal compliance. While smaller, retail investors may not be able to make a significant impact on a stand-alone basis, when pooled with other like-minded investors, their financial contribution is magnified. Investing in one mission together with others of a similar mindset, the community can generate media and raise capital at a sufficient scale to accelerate growth. As a bonus, these platforms open doors for startups to connect with investors globally. Furthermore, equity crowd funders are not required to be accredited investors. Equity crowdfunding is thus considered less expensive and less time consuming than other ways of raising funds.

What are the Risks and Benefits?

Equity crowdfunding platforms are not an automatic assurance for investment. Investors still must conduct due diligence and startup founders still need to ensure foundational aspects are in place before seeking investments. These portals are designed to provide startups with additional platforms to engage a wider audience, and to protect retail investors by requiring startups to have undergone a light form of business diligence at their own expense before the first issuance of equity is permitted.

Another advantage of equity crowdfunding platforms is that they can provide opportunities to sponsor conferences, arrange webinars and facilitate introductions between investors and entrepreneurs. In the current virtual format, this can be accomplished with high resolution and speed over digital media. Additionally, crowdfunding platforms provide a variety of forums for discussions and dissemination of marketing literature and content.

There are also downsides. With a population of retail investors who invested in your company and who cannot necessarily afford to lose the money underlying their investment, you are at a greater risk of negative publicity if your business disappoints in any way. Apart from personalized and often strongly worded letters, emails, texts and posts, thousands of angry investors could mean a tidal wave of negativity, media, and even potential class action lawsuit.Does Crowdfunding Really Save Time and Money?

A benefit of the JOBS Act is that allows entrepreneurs to bypass lengthy public filing requirements that would normally come with a registered initial public offering. While indisputably less expensive and quicker to prepare, there are nonetheless abbreviated and streamlined compliance requirements to observe. Four years after the JOBS Act was signed, Regulation CF of the JOBS Act was promulgated by the Securities and Exchange Commission. Companies are limited to raising an aggregate amount of $5 million in a 12-month period through equity crowdfunding offerings. The $5 million cap was recently raised from the $1,070,000 annual cap on Regulation CF. This is something that would not apply if a company chose to go with venture capital or angel investment options. Companies are still able to seek out other forms of financing, so there is an option to raise additional funding if needed from other more traditional avenues of funding. Additionally, Regulation CF requires all transactions to take place online through a Securities and Exchange Commission registered intermediary, either a registered broker-dealer or a qualified funding portal. There is also a limit to the amount of individual non-accredited investors who can invest across all crowdfunding offerings in a 12-month period. - Q16. What Happens to Startup Culture After a Merger or Acquisition?

Successfully selling your startup to a larger player or succeeding in helping your big tech or big pharma company buy a hot new startup on the cutting edge is a barometer of success in the global Silicon Valley in 2021. But integrating a tiny startup into a much larger company can be challenging, typically because the larger company operates with more process and structure, and the startup operates based on deeply held values. A hallmark of successful combinations is forming a common view on culture and shared values. When cultural differences exist, they can become severe enough to derail integration. While disputes over perks might frustrate employees, cultural differences can be much more serious, such as how leaders make decisions or how managers relate to their subordinates.

The first step to reconciling cultural differences is identifying them. A cultural integration team, composed of key people from both cultures, can work on the differences and decide what to keep and what to change. Identify, if you can, the implicit assumptions of each entity. Determine which align with the combined company’s goals and vision. Keep what will help. Change what will not.

Communicate early, often, and clearly along the way. Ask for input and pay sincere attention to it. People will support what they help to create. Strive for one company, one culture, with leaders modeling the desired behaviors and transparency.

Be aware that merged or about-to-be merged companies are ripe for poaching. Incentivize new behaviors and strive to retain talent. Pay for performance. Reward historical contributions with cash and future contributions with equity. Compensation is a powerful tool in both the pre-close execution phase and post-close integration. Retention awards and transition incentives are typically used to supplement other incentive or severance programs that might already be in place. Retention awards are usually vested at specific milestones, while transition incentives are often vested based on achieving specific objectives. Together they are a powerful combination.

In designing culture and values, rewarding past performance and incentivizing accountability for future performance metrics will govern behaviors going forward. Designing success is partly a form of art and partly science and execution.

- Q17. What Do I Need to Know About Buying and Selling Shares of Private Company Stock?

Stockholders in many private companies are increasingly participating in “liquidity rounds,” also known as secondary sales, where they sell shares of stock for cash before the company goes public. There are many factors that a holder or a private company should consider when deciding if and how to structure this type of transaction. Will a liquidity transaction help a company retain key talent, or is it enabling its own demise by helping its key talent achieve an early exit? Is it fair to those who are participating and those who are not given access? There are also specific steps a company can take to control secondary transactions in its stock in the future.

The following is a brief legal guide to key considerations in buying and selling shares of private company stock in liquidity rounds.

Liquidity transactions can be structured as a buyback of shares by the company—funded by balance sheet cash or cash from an equity financing. Alternatively, the transaction might be structured as a direct purchase of shares by a third party, pairing the purchase with a company’s primary equity financing or even as a standalone transaction. In a company-sponsored transaction, the company must decide the limits and the stockholders that can sell shares.

Just like with any securities transaction, it’s wise to consult with the company’s legal and tax advisors to be sure that all required approvals are received, determine the appropriate tax, reporting, and withholding requirements, and prepare the right documentation. Other important legal considerations must be considered, including what disclosures are made by the seller to the buyer, and who knows what at that time. Will the information about the issuer leak to competitors or cause damage if learned by customers? These concerns can be accentuated in a tender offer by a company or a third party to holders. What will be said in a future S-1 filing about the transaction? How will the transaction impact a company’s prior or subsequent determination of the fair market value of its common stock for purposes of making future equity grants (e.g., the “409A value”)? What capital gains will be reported? How will such a transaction impact the federal tax-free status of the shares under Section 1202 of the Internal Revenue Code, commonly referred to as “QSBS rules?”

Just as with any transaction involving stock, the parties may be liable for disclosing relevant material and nonpublic information to the other parties (or for failing to make the disclosures). This is critically important when the sellers do not have board-level details about the company. Whether the company has liability exposure will depend on its involvement and the relevance of any undisclosed information. Making disclosures to potential buyers can trigger leaks to competitors, customers, suppliers, or other ecosystem players that could be dangerous to the issuer of the stock.

When secondary purchases are made via a “tender offer,” depending on the number of sellers, the transaction may need to be structured to comply with certain components of the SEC’s Regulation 14E.

Moreover, transactions occurring between the company, its officers, and others within the three years prior to the IPO must be disclosed as related-party transactions in the company’s IPO filing on Form S-1. A third-party purchase not involving the company could be required to be disclosed depending on its materiality. Some states, including Delaware and California, have statutory balance sheet tests limiting the amount of capital that a company can use to buy its shares.

The degree to which any transaction will impact the company’s 409A valuation depends on the terms of the transaction, the parties’ identities, the transaction size, and the valuation firm’s methods.

A purchase of shares priced above what the company’s board of directors otherwise considers “fair market value” of the common stock creates the risk that current or former employees or service providers selling shares won’t be able to claim capital gains treatment on 100 percent of the sale price. So, the difference may need to be taxed as regular income, and then the company may have a withholding obligation.

A company’s buyback of shares may impact whether the shares held by other stockholders qualify as QSBS for federal income tax. A third-party purchase will not have this impact, but the shares purchased won’t be eligible as QSBS. Therefore, consideration should be given to whether the transaction requires a “Hart-Scott-Rodino” antitrust filing, which involves much effort and a hefty fee.

How do you ensure your company has control over secondary transactions in shares in the future? It would help if you considered implementing a “right of first refusal” over your company’s stock transfers. Common stock can be subject to a right of first refusal, which provides the opportunity to purchase shares that a stockholder proposes to sell to a third party. The right of first refusal is usually contained in the company’s bylaws, so it automatically applies to all shares issued after the bylaws are adopted. This is a useful way to control stock ownership to the extent that the company or its assignee can spend the necessary funds to purchase the shares. If not, the shares can be sold to the proposed buyer.

A private company tends to feel pressure to provide liquidity to its stockholders as its value increases. So, whether you decide to engage in a liquidity transaction or permit your stockholders to sell while the company is private, setting your stockholder expectations both early and clearly can go far. Getting the details right will save you legal, accounting, HR, and tax headaches that are imminently avoidable.